Incentives from my employer

Profit-sharing |

Optional profit-sharing |

Employer contribution |

Two kinds of collective agreements may be in place at your company:

Profit-sharing

Profit-sharing is a legal mechanism that is required of companies with more than 50 employees, which must redistribute to their employees a share of the profits that their work helped to earn. This incentive is paid only if the company earned a profit over the year in question.

Optional profit-sharing

Optional profit-sharing is a mechanism for employers that want to give their employees a financial stake in the company's performance, based on set criteria, which may include earnings growth, productivity increases, or improvement of customer care, among other possibilities.

Whether an optional profit-sharing is paid – and how much – depends on the achievement of goals set in the collective bargaining agreement between the employer and the employee representatives. That agreement also defines how the optional profit-sharing is distributed among employees.

Your employer pays the profit-sharing and optional profit-sharing before the first day of the sixth month after the end of the reporting year (ie before 1 June for a company whose year ends on 31 December).

You’ll then have the option to pay all or some of your incentives into your savings plans.

They won’t count toward the cap on contributions into PEE and PERCO plans (up to 25 per cent of gross annual salary).

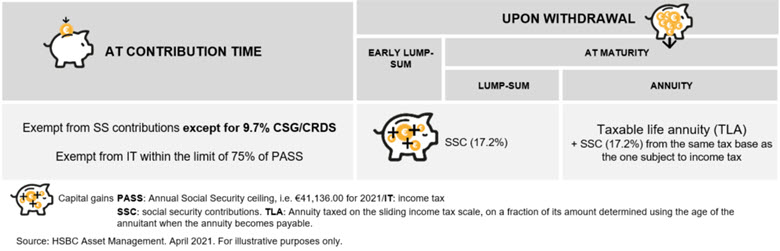

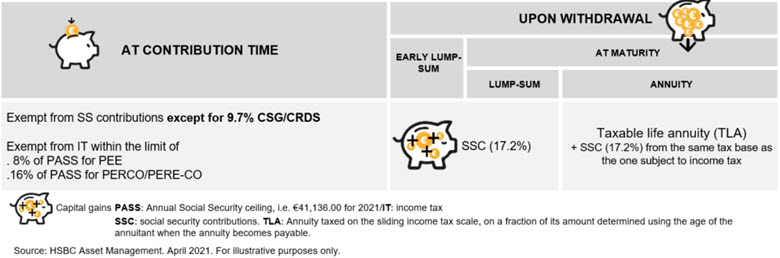

Taxation of incentives invested

If you choose to collect your incentives instead, they’ll be subject to income tax.

Employer contribution

Your employer may decide to supplement your contributions (voluntary contributions, profit-sharing and optional profit-sharing) into your employee savings plans.

A match meter in your secure account shows at a glance:

- The details of the matching fund rules in place at your company

- The amount of matching funds you've already received since the start of the year and the potential amount yet to be collected

Taxation of employer contribution

y

y  y

y