Build my savings

With the help of your employer, you can access tax-advantaged saving solutions.

Employee savings are a major asset for organising the funding of your projects, no matter what they are: buying your primary home, paying for your children’s education, setting aside an emergency fund, or preparing for your retirement.

Employer-offered solutions

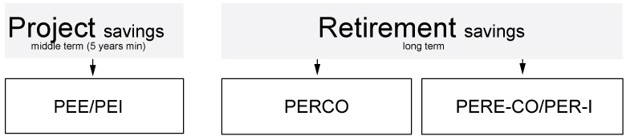

Your PEE/PEI offers the option to build medium-term project savings (locked in for at least 5 years)

Your PERE-CO/PER-I and PERCO allow you to receive additional income in retirement.

Tax-advantaged, financially sound savings

- Your profit-sharing and optional profit-sharing are exempt from income tax (up to the statutory caps) and social security contributions (excluding CSG and CRDS),

- You can also convert your untaken leave days, or the days in your time savings account (CET), into retirement savings. If you choose to do this, the amounts transferred are exempt from income tax (up to 10 days per year),

- If you have a PER, you can make voluntary contributions that are deductible from total net income up to the retirement savings cap*

*To find out the maximum amount that each investor can deduct, please refer to the deduction limit that appears on your most recent income tax notice. Note that it is possible to apply the spouse's unused limit if filing a joint return.

Flexible, painless plans so you can easily build up your savings

- Numerous sources of funding

- The ability to define the contribution amount and frequency that are right for you

- A range of investment vehicles that meet your needs and values

- Can be unlocked early in certain cases if needed

y

y  y

y  y

y