Group Retirement Savings Plan (PERCO)

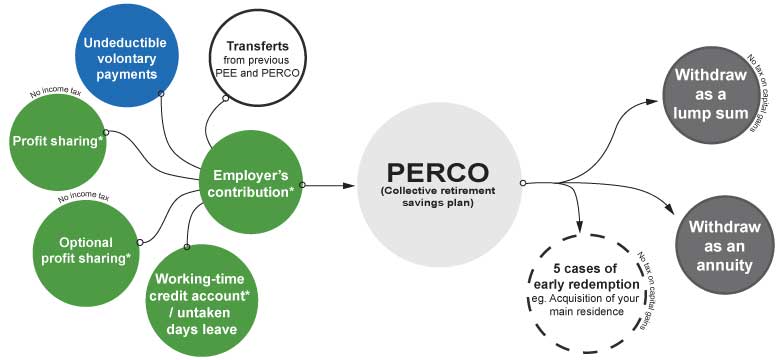

PERCO funding sources |

Investing my retirement savings |

Withdrawing from a PERCO |

PERCO funding sources

- voluntary contributions,

- incentives paid by your employer: profit-sharing, optional profit-sharing, and employer contributions under the agreements in force within your company,

- Time (days banked in a CET account or if there is none RTT hours time off in lieu), paid leaves beyond the 4th week.

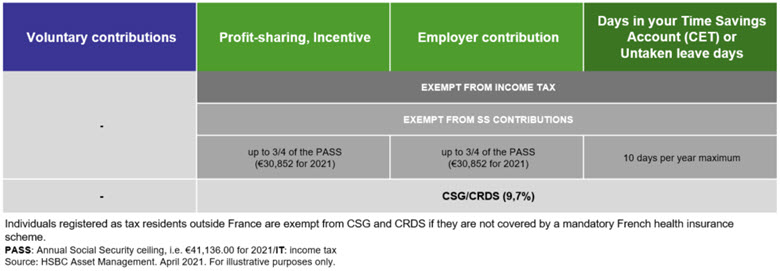

Taxation of the PERCO on entry

Your employer covers your account-keeping charges. Your voluntary contributions are limited to 25% of your gross annual income (all employee savings plans combined).

Investing my retirement savings

The amounts are paid into units of employee shareholding funds (FCPEs) which have different management profiles. For your investments, you have access to:

- A so-called “delegated management” system whereby you delegate the investment of your savings according to an investment horizon (e.g. retirement)

- A so-called “self-directed management” whereby you choose your investment vehicles on your own.

In any case, your choice can be modified at any time.

Withdrawing from a PERCO

The savings are locked until retirement, but the following 5 reasons will allow you to collect it early.

|

Acquisition of principal residence/Extension of principal residence |

|

Disability (beneficiary, child, spouse or civil partner) |

|

Over-indebtedness of individuals |

|

Lack of job (Expiry of unemployment insurance entitlements) |

|

Death of spouse or civil partner |

Upon maturity, you can choose to collect all or some of your savings as lump sum or an annuity, but you can also keep all or some of your savings in the plan, or withdraw your assets as an annuity.

All or part of the capital built up in your PERCO can be transferred to an insurance company in exchange for an annuity.

This means the capital accrued in your PERCO is swapped for an individual insurance policy that guarantees you this income. HSBC Epargne Entreprise will transfer your capital to whichever insurer you choose.

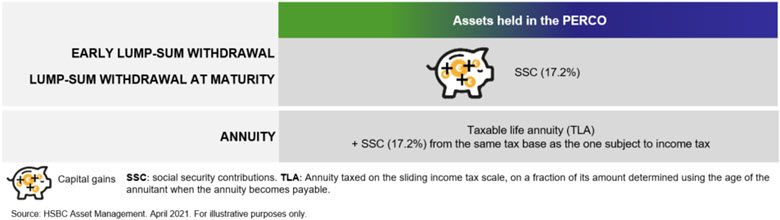

Taxes upon withdrawal from a PERCO

When withdrawing from the PERCO, only capital gains on the invested amounts are taxed. They are subject to social security taxes (17.2%).

If you choose to withdraw as an annuity, it will be taxed advantageously as an annuity with a load.

Social security contributions are deducted by HSBC Epargne Entreprise when you withdraw your savings and then paid directly to the authorities.

Capital gains are determined on the basis of a Weighted Average Acquisition Price (PMPA), which is the weighted average of the various acquisitions prices of securities.

To know more about Weighted Average Acquisition Price (PMPA) calculation

y

y  y

y