My project savings

What are you saving for?

Do you have a medium-term project (5 years) like buying a home, getting married, renovations, funding your children’s education, or just setting aside money for a rainy day?

Employee savings, thanks to the PEE, can help you finance them under particularly attractive conditions.

The company savings plan (PEE)

PEE funding sources |

Investing my savings |

Withdrawing from a PEE |

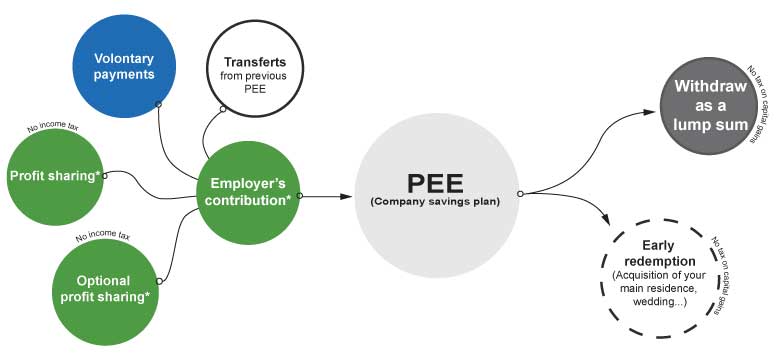

PEE funding sources

- voluntary contributions,

- incentives paid by your employer: profit-sharing, optional profit-sharing, and employer contributions under the agreements in force within your company,

- transferring assets from old PEEs.

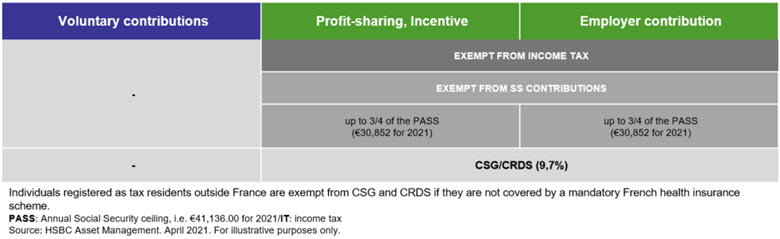

Taxation of the PEE on entry

Your employer covers your account-keeping charges.

Your voluntary contributions are limited to 25% of your gross annual income (all employee savings plans combined).

Investing my savings

The amounts are paid into units of employee shareholding funds (FCPEs) which have different management profiles. For your investments, you have access to:

- A so-called “delegated management” system whereby you delegate the investment of your savings according to an investment horizon (e.g. retirement)

- A so-called “self-directed management” whereby you choose your investment vehicles on your own.

In any case, your choice can be modified at any time.

Withdrawing from a PEE

The savings are locked for 5 years, but there are many situations that allow you to collect it early like getting married or buy a home.

Upon maturity, you can choose to collect all or some of your savings as lump sum but you can also keep all or some of your savings in the plan.

Taxes upon withdrawal from a PEE

When withdrawing from the PEE, only capital gains on the invested amounts are taxed. They are subject to social security taxes (17,2%).

Social security contributions are deducted by HSBC Epargne Entreprise when you withdraw your savings and then paid directly to the authorities.

Capital gains are determined on the basis of a Weighted Average Acquisition Price (PMPA), which is the weighted average of the various acquisitions prices of securities.

y

y  y

y  y

y  y

y