Collective Retirement Savings Plan (PERE-CO)

PERE-CO funding sources |

Investing my retirement savings |

Withdrawing from a PERE-CO |

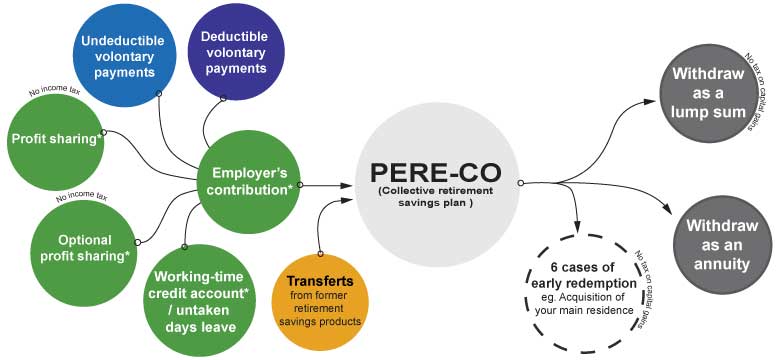

PERE-CO funding sources

- voluntary contributions that you can choose to deduct from your total net income for income tax purposes,

- incentives paid by your employer: profit-sharing, optional profit-sharing, and employer contributions under the agreements in force within your company,

- Time (days banked in a CET account or if there is none RTT hours time off in lieu), paid leaves beyond the 4th week

- Transferring old retirement savings products (Artcile83, PERP, PERCO, etc.) under certain conditions.

Your employer covers your account-keeping charges.

Your yearly voluntary contribution are not capped, but if you have deductible voluntary contributions, they are limited to your retirement savings cap.

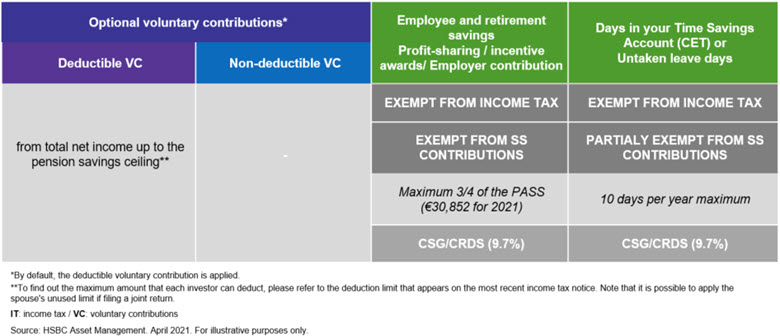

Taxation when paying into a PERE-CO

The collective retirement savings plan is made up of different compartments based on the source of the funds distributed or transferred and the type of management you choose for your investment vehicles (self-directed or life-cycle management). So your savings will be distributed according to the source of your assets.

Funds from employee profit-sharing/optional profit-sharing, time savings accounts, and any employer contributions will be paid into your employee savings compartment.

Investing my retirement savings

The amounts are paid into units of employee shareholding funds (FCPEs) which have different management profiles. For your investments, you have access to:

- A so-called “delegated management” system whereby you delegate the investment of your savings according to an investment horizon (e.g. retirement)

- A so-called “self-directed management” whereby you choose your investment vehicles on your own.

In any case, your choice can be modified at any time.

Withdrawing from a PERE-CO

The savings are locked until retirement, but the following 6 reasons will allow you to collect it early.

|

Acquisition of principal residence/Extension of principal residence |

|

Insolvency procedures (termination of unsalaried work/conciliation procedure – company in too much debt) |

|

Disability (beneficiary, child, spouse or civil partner) |

|

Over-indebtedness of individuals |

|

Lack of job (Expiry of unemployment insurance entitlements) |

|

Death of spouse or civil partner |

Upon maturity, you can choose to collect all or some of your savings as lump sum or an annuity, but you can also keep all or some of your savings in the plan.

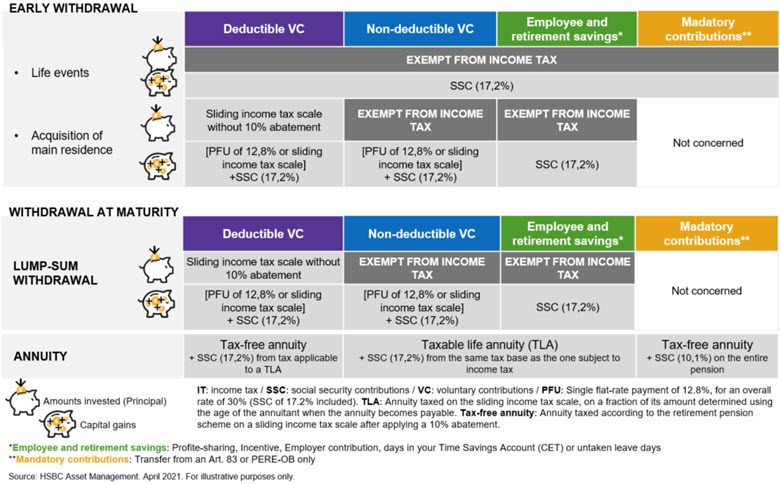

Taxes upon withdrawal from a PERE-CO

Upon withdrawal from the plan taxation differs depending on the nature of the funds invested and the type of withdrawal you opted for

Social security contributions are deducted by HSBC Epargne Entreprise when you withdraw your savings and then paid directly to the authorities.

Capital gains are determined on the basis of a Weighted Average Acquisition Price (PMPA), which is the weighted average of the various acquisitions prices of securities.

y

y  y

y